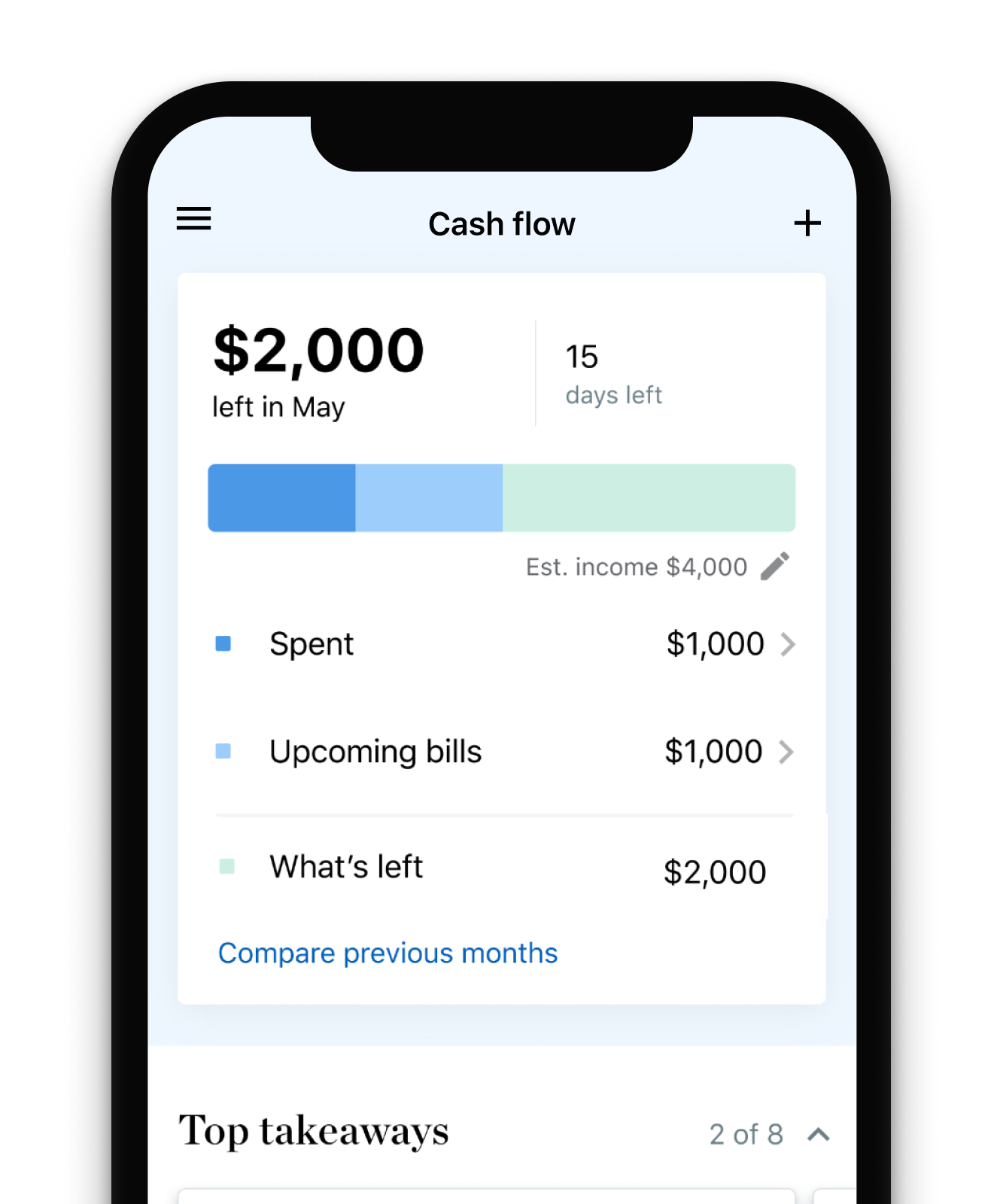

The home feed is a marvel of charts, illustrations, and spending trackers, and each one is designed with genuine flair. Clarity neatly organizes itself into four tabs: a home feed, an accounts page, a search tool, and your profile. That’s why I’ve come to prefer Clarity Money, a venture-backed startup with an iOS app that launched in January.

#WHAT IS THE BEST EXPENSE TRACKER APP FREE#

You’ll get the hang of Mint eventually, and few apps can boast more or better free tools. It can feel as if the various financial widgets have been sprinkled throughout the app at random. (What is the difference between “updates” and “overview”?). Where Mint falls down is in its mobile design - which is a shame, since its original website won critical acclaim when it debuted in 2006. Mint’s promotions can feel overly aggressive its mobile app has an entire tab devoted to these “offers,” when most people I know won’t open a single new credit card all year. It’s all interspersed with ads for credit cards, life insurance, and other financial tools, which is how Mint makes money. Plug in credentials for your financial institutions and Mint will create a solid overview of your finances: recent transactions, upcoming bills, a breakdown of your monthly spending, and more. Mint’s promotions can feel overly aggressive its mobile app has an entire tab devoted to these “offers” And three, it’s ubiquitous - you can get it on Android, iOS, and the web. Two, it has continually invested in new features since being acquired by Intuit in 2009, and it now offers tools for paying your bills, checking your credit score, and making progress toward your savings goals. Mint is easy to recommend for three reasons: one, it’s a trusted, venerable app in a space where lots of players come and go. I’m going to suggest you consider two: Mint, a feature-packed personal-finance stalwart owned by Intuit and Clarity Money, a beautifully designed up-and-comer that is now available on iOS and Android.

If anything, you have too many options here - there are dozens of good-enough budgeting apps out there, but the best budgeting app will always be whatever works best for you.

Your bank’s app will likely give you some basic insight into your checking account, but you have better options for getting a more holistic view. You need to understand what you can afford to spend funds on, and then monitor your spending in real time. The first step toward getting your finances in order is getting some insight into your spending habits.

#WHAT IS THE BEST EXPENSE TRACKER APP ANDROID#

Mint iOS: Clarity Money Android and iOS: Clarity Money and Mint Until you’ve done that, you probably don’t need an investment app. Most people are better off maximizing their investments in a tax-advantaged retirement account, such as a 401(k) or an IRA. We also looked at apps that help to automate investing, but I’m not comfortable recommending one. Here are our picks for the essential finance apps for planning your budget, tracking your spending, monitoring your credit, and paying your friends back. But if you’ve never examined your spending by category, or saved more than $100, there have never been easier ways to get started. If you’re happy with your current setup, there’s no pressing need to change it. The bad news is that there are hundreds to choose from.

The good news is that there are tools in your local app store to handle just about all of your everyday finance needs. Your bank’s app will tell you how much money is in your account, but when it comes to getting a picture of your overall finances, or saving for a major purchase, or splitting the tab at a restaurant, you’re pretty much on your own. You can get by with a single app for music, maps, notes, and calendars, but when it comes to managing your money, no one app will do. If you’re just learning to get your finances in order, or you’re ready to start giving them some more thought, you have a wealth of app options. You can get by with a single app for music, maps, notes, and calendars, but when it comes to managing your money, no one app will do

0 kommentar(er)

0 kommentar(er)